Table of Content

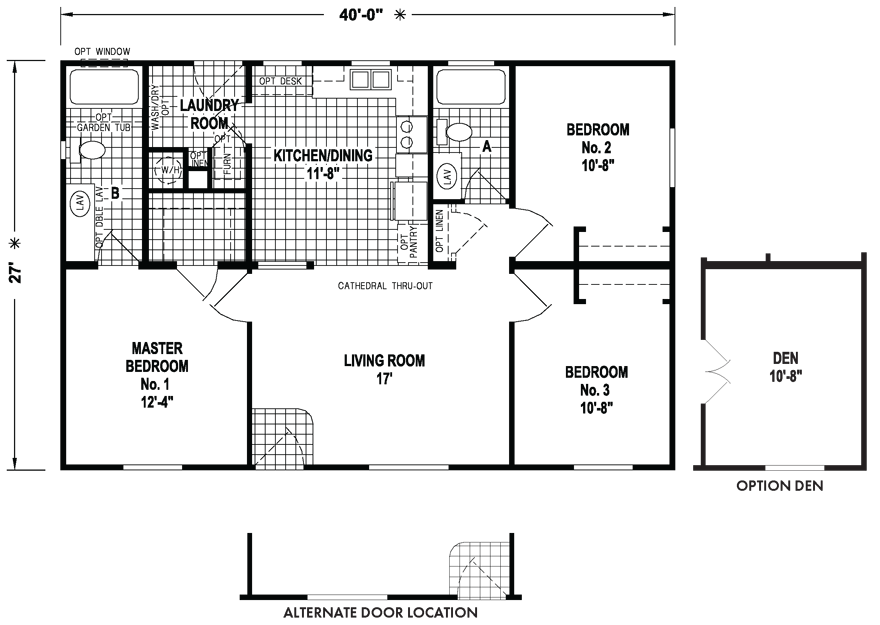

The tax deduction available is up to $1.80 per square foot, and partial deductions of up to $0.60 per square foot are also possible. While the tax credit can cover the cost of the materials themselves, it cannot include installation costs. You must have a receipt showing the cost of the insulation.

This should shift the supply curve of cigarettes to the left d. This should shift the supply curve of cigarettes to the right. This should shift the demand curve for cigarettes to the left. This should shift the demand curve of cigarettes to the left.

Want to see the full answer?

There are many benefits to insulation, both for your home and the environment. Insulation can help you save on your energy bills, make your home more comfortable, and protect against moisture damage. TruTeam’s expertly trained installers will come to your home to do a free on-site evaluation of your current insulation. We can make recommendations on where and how to add more insulation and then provide professional installation services. If you’re scared by the immediate out-of-pocket expenses for home insulation, you can rest assured.

This program includes solar panels, wind-powered technology, and some home insulation. Determine whether each of the following statements is true, false, or uncertain. Then briefly explain each answer. In equilibrium, all sellers can find buyers. In equilibrium, there is no pressure on the market to produce or to consume more than is being sold.

R-Values for Insulation

Quantity goes down when wages rise, the supply curve shifts leftward, increasing equilibrium price. The increase in the price of aluminum should lead to an increase in the demand for steel. The rightward shift in demand will push equilibrium price and quantity up. The price is indeterminate depending on how much the demand and supply shift. Yes, the recently reinstated Federal 25c tax credit provides homeowners with an insulation tax credit worth up to $1200. Homeowners who insulate their homes with spray foam can write off their expenses and get a 30% tax credit.

Older homes are far less likely to be energy efficient, but increased insulation is the most excellent renovation a homeowner could make. As with any product, bond or stock, the laws of both demand and supply results in the changes of oil prices. Once supply exceeds demand, prices tend to fall and the vice versa is also true in the case that demand outperforms supply. Think about whether each event increases or decreases supply or demand for oil and you should be able to figure out the effect upon the price of oil. I'll be happy to critique your thinking, but am quite sure able to do figure this out. Such credits decreased the demand for oil and lowered the world price.

212000 2 2120000 3 212000 4 21200 22 25 is multiplied by 10 to the fifth power

Centralizing production led to reduced transportation costs. To be eligible for the credit, you must own your home and your insulation must meet certain requirements. The insulation must be installed in an area that is considered to be part of the living space, such as the attic or crawl space. The insulation must also meet certain R-valuerequirements. Continuous insulation is a thermal barrier for residential & commercial construction.

Give some examples and explain the direction in which the curve shifts. Law of demand- as price drops the quantity increases. Students buying less gasoline when the price per gallon rises 2. Buying fewer take-out pizzas when the price of pizza rises. As the price of the good rises, the quantity demanded decreases. As the price of the good falls, the quantity demanded increases.

insulation. b. The Alaskan pipeline was completed. c. A supposed

Tax credits are offered for expenditures on home insulation. Select three from the following list of changes and explain the effect on the price of oil. Also describe what could cause the price to move in the opposite direction. A deficit indicates that the country is buying more goods from other countries than it is selling to other countries. An external cost is a cost not reflected in the price of the good and therefore is ignored by the buyers of the good.

Domestic producers and their employees benefit from trade restrictions on imports as both the price and quantity sold of domestic production increase. Domestic consumers are harmed as they face higher prices. Domestic exporters and their employees also suffer as the overall volume of trade is reduced.

Private markets can lead to a very unequal distribution of income. Finally, private markets do not guarantee full employment, price stability, and economic growth. The tax credits for residential renewable energy products are now available through December 31, 2023. As of 2021, biomass fuel stoves are included in tax credits for residential renewable energy products.

The government can benefit from revenues generated by the tariffs and the selling of import licenses under a quota. Home insulation has numerous financial benefits in addition to the energy-efficient tax credit. Primarily, these benefits include lower electricity bills and increased home value.

Nominal income, is constant as you move along a demand curve, and real income, which changes whenever the nominal income or price changes. Private markets may fail to safeguard private property and enforce contracts. In a completely private market, firms may collude to avoid competition.

Opportunity costs fall as there are fewer chances for working outside the home. Opportunity costs rise as women forgo higher earnings if they do not work outside the home. Opportunity costs fall as there are fewer employment opportunities for women in these traditional industries. Federal- individual income tax State- income and sales tax Local government- property taxes. 2 greatest sources of tax revenue, personal income taxes and payroll taxes .

It is important to choose an insulation that will not absorb moisture, as this can lead to mold and mildew growth. You may have heard of ENERGY STAR rebates for products like refrigerators, washers, HVAC systems, water heaters, and more. Products that earn the ENERGY STAR label meet energy efficiency standards established by the EPA. While there are no specific ENERGY STAR rebates for the purchase of insulation, there are many different insulation products that carry ENERGY STAR certification. Click here for a list of these products or check with a TruTeam installer to see if your chosen insulation is ENERGY STAR certified. What kinds of changes in underlying conditions can cause the supply curve to shift?

Following this, increase in supply results in a reduction in prices (Baumeiste & Kilian 2016). Choose any two of the above variables, and describe how your selections would affect oil prices based on the supply and demand analysis. Changes in prices of other goods 3. Consumer tastes A reduction in the price of a normal good causes a movement along the demand curve, an increase in quantity demanded, not an increase in demand. If you want to take advantage of the insulation tax credit, insulation products such as batts, rolls, blow-in, rigid boards, expanding spray, and pour-in-place insulation qualify. These tax credits have been extended several times and currently are set to expire at the end of 2021.